As we enter what some are predicting will be a new Roaring ’20’s, as economies “bounce back” from CovEcon-19, it is instructive to look back to the original “Roaring ’20’s”. As now during the second decade of the 20th Century short selling was one of the sophisticated financial products individuals could speculate with.

If you have not come across short selling it is a kind of financial alchemy that transforms base metal, failing companies into sources of golden profit. This process of transmogrification has the following 3 basic steps.

Step 1 You “borrow” a share in the base company (Base Co) paying a rental fee for it for a fixed period of, say, six months. Assume for this example that the stock market value for a share in Base Co. is £100 when you borrow it. Also assume you pay rent at £0.50p per month for the 6 months therefore total cost of borrowing the share is £3.

Step 2 Immediately sell the share you have borrowed for £100. Now you have cash £100 but no shares, an obligation to pay £3 in rent and to return the share in six months.

Step 3 At the end of the six month period buy a share in Base Co at the prevailing stock market price. This step is where the magic happens… you hope.

What you hope is that the share price will have gone down in the course of the six months so that you can buy the share at less than it was worth when you borrowed and sold it.

Assume you are a clever alchemist and the share at the end of six months has halved in value and therefore only costs £50 to buy. In these circumstances you have made a profit of £47 which is arrived at as follows: £100 – (£50+£3) = £47 Result “Happy Days!”

Of course, you might be a poor alchemist in which case the value of the share you have to purchase at the end of 6 months may have gone up to say £150. Now you are down on the deal: £100 – (£150 + £3) = -£53 Result “Ouch!”

If the share price remains at £100 for the six months you have to go into the market and buy them at that price to give them back so you are £3 down on the deal.

Of course you may have increased your investment in this process by borrowing money and buying more shares. This increases your profit but also your loss depending on whether you are a good or bad alchemist. This has the effect of changing the “Ouch!” into an “Aagh!” and the “Happy Days” into “Yipee aye ay”

“Isn’t all this just like gambling? What commercial benefit does it produce in the real economy?” I hear you ask. My instinct is the answers are “yes” and “none”. If that all sounds on the shady side, consider the following.

Between, September 23 and November 4 in 1929 a Mr AH Wiggins, variously President, Chairman of the board and Chairman of the governing board of the Chase bank on Wall Street short sold 42,506 shares of the bank he was the President, Chairman etc of. He was a successful alchemist as he borrowed and sold ahead of the Wall Street crash and purchased and returned when the shares had fallen significantly in price.

As Chase bank’s shares continued to tumble he acquired another 43,506 of Chase shares from an affiliate of the bank, partly financed by a $6.6m loan from his employer – Chase bank! As the bank’s shares continued to collapse he again repurchased at a much reduced price and made a $4m profit on the transactions.

Mr Wiggins was later questioned about whether he felt it was right as a senior employee of the bank he should make a profit out of speculating in its shares using money loaned to him by the bank. Mr Wiggins answer was that by lending the money to employees and allowing them to speculate in its shares the bank was encouraging its staff to have an “interest” in the company.

When asked whether short selling created the right kind of “interest” in the company he thought it doubtful!

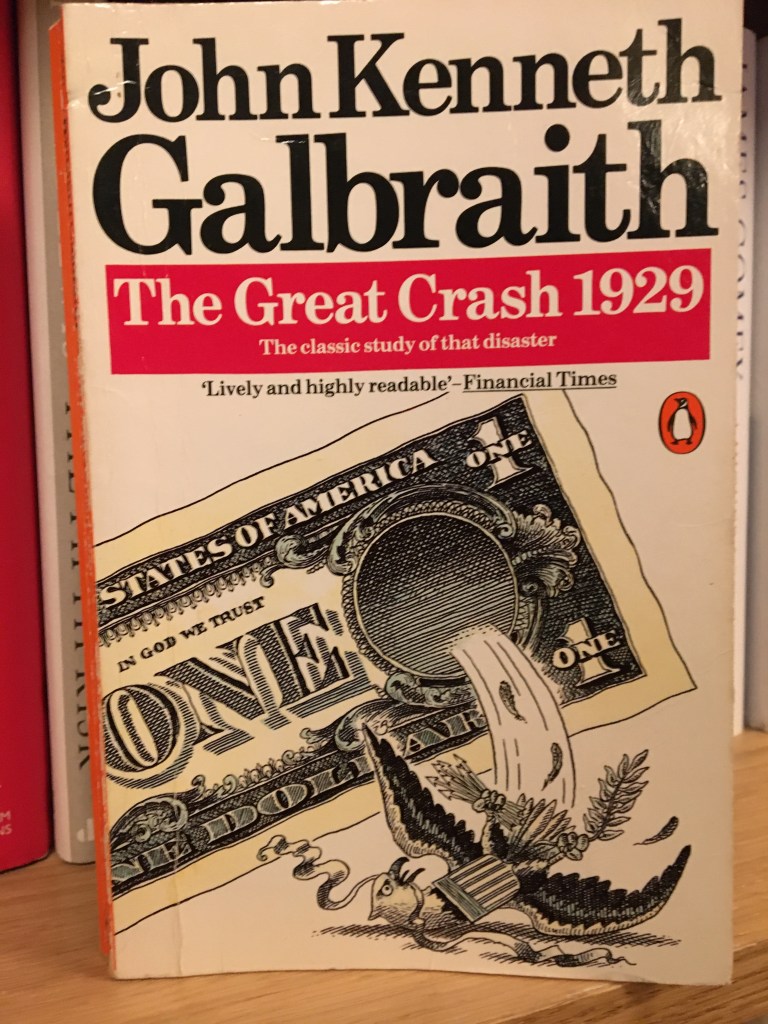

Mr Wiggins story is recounted in JK Galbraith’s incisive and witty analysis of “The Great Crash of 1929”. Reading it you see haw egregious practices of the past have been replaced by egregious practices of the present. The parallels with both 2008 and now are instructive.

The Roaring Twenties were a period of excess with growing inequality, enormous optimism about the benefits of capitalism and the rejection of the need for red tape regulation. If we do have an economic bounce back we just need to remember how those Roaring Twenties ended. We should try not to fall into the same trap.

Whilst there are far more regulatory conditions to be met on short selling now as compared with the original Roaring ‘20’s, the question has to be asked why is it allowed to take place at all? What is the commercial benefit in the real economy?

On the negative side, it certainly does not help target companies if large hedge funds are gambling against their success or even survival. Also it creates “immoral hazard” in that powerful financial interests have a strong motive to undermine the company in whatever way they can and certainly have no interest in its success.

I would welcome explanations of the benefits of short selling. I suppose Schumpeterian capitalists may see short selling as a way to weed out the weak quicker than normal share sales. It perhaps provides a hedging mechanism for large funds to manage their risk exposure to moves in the market.

However, to the extent that large enough funds may be able to create a self-fulfilling prophesy it starts to look like a one way bet which may destroy perfectly good companies who are experiencing a difficult patch.

Short selling looks more like it operates for the participants who play casino capitalism rather than those looking to ensure the efficient allocation of investment. For Wall Street over Main Street.

The events around GameStop shares and Robinhood’s purported desire to democratise finance gives a poke in the eye to the Goliath hedge fund managers and their short selling activities. It is difficult not to derive a certain satisfaction from this. However, it is probably not the best way to reign in value destroying speculation.

The thousands of day traders who have bought the shares of GameStop at over inflated prices are clearly not looking to make money, they are looking to take revenge on those powers which seem to determine much of their future and face little if any risk themselves. I suspect in the mix are a number of very savvy investors who are making money on the upward price of the shares.

The motives of many who are participating in this action are definitely on the money, even if their money is not. The financialisation of the economy has gone on for far too long. Reform is needed and effective regulation of Wall Street must be a part of this. Only the state can ultimately achieve an economic environment driven by values which works for the many and not just the few. The Biden administration has a lot on its plate but this needs to be addressed if the despair that fuels anger and division is to be overcome and unity achieved.